Ever wondered if the home improvement giant, Floor & Decor, reports its financial information to a credit reporting agency like Dun & Bradstreet? While you might not think about it often, this seemingly mundane question can have a significant impact on businesses, especially smaller ones looking to partner with or secure financing from Floor & Decor. Understanding how these data networks operate can be crucial in navigating the complex world of business credit and securing favorable terms.

Image: fitsmallbusiness.com

Unveiling the Information Ecosystem: D&B and Business Credit

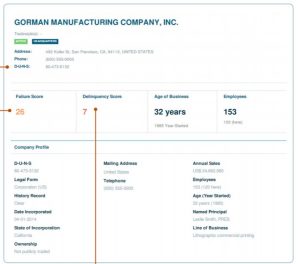

Dun & Bradstreet (D&B) is a global leader in business credit reporting, providing essential data and insights to companies around the world. It collects and compiles information about businesses, generating credit scores, financial health assessments, and reports that offer a comprehensive picture of a company’s financial standing. This information is vital for banks, suppliers, lenders, and investors to make informed decisions about extending credit, offering loans, and evaluating potential business partners.

Understanding the Significance of Reporting to D&B

Reporting to D&B is an important step for businesses seeking to establish and build a strong credit history. A positive track record with D&B can:

- Increase creditworthiness: A high D&B score can signify a financially stable and reliable company, making it more likely to receive favorable credit terms from lenders and suppliers.

- Improve access to financing: Banks and financial institutions often use D&B scores to evaluate loan applications, so a good rating can enhance your chances of getting approved for loans and securing better interest rates.

- Enhance business partnerships: Strong D&B data can boost your reputation in the business community, making it easier to attract valuable partnerships and collaborations.

Floor & Decor’s Reporting Practices:

While Floor & Decor operates in a sector that relies heavily on credit, the company’s reporting practices to D&B remain a mystery. It’s essential to understand why this information is so hard to find.

- Proprietary Data: D&B data is generally proprietary and not publicly available. While some basic information about a company’s creditworthiness might be accessible through public records, the detailed data used to calculate D&B scores is kept confidential.

- Privacy Regulations: Data privacy regulations, like the General Data Protection Regulation (GDPR) in Europe, restrict the sharing of sensitive business information without consent.

- Confidential Business Practices: Companies often choose not to publicly disclose their credit reporting practices, considering this information to be strategically sensitive.

Image: ir.flooranddecor.com

What Can Businesses Do?

While Floor & Decor’s reporting practices to D&B might be unknown, there are steps businesses can take to enhance their own creditworthiness:

- Establish a D&B Account: Create a D&B account to access your credit reports and make any necessary updates or corrections.

- Pay Bills Promptly: Consistent and timely payments to suppliers, creditors, and lenders contribute to a positive credit history.

- Manage Credit Limits Wisely: Avoid using excessive credit and strive to maintain a healthy credit utilization ratio, which reflects your credit usage compared to your available limit.

- Monitor Credit Reports Regularly: Review your D&B credit reports periodically for any errors, inconsistencies, or potential issues.

The Future of Business Credit Reporting: Transparency and Openness

The increasing demand for greater transparency and accountability in business credit reporting is prompting agencies like D&B to evolve their practices. While some information remains proprietary, there is a growing push towards more accessible and comprehensive data sharing.

- Data Sharing Platforms: Emerging data-sharing platforms are enabling businesses to access and share their credit data more seamlessly, leading to better informed decisions and potentially greater transparency.

- Blockchain Technology: Blockchain technology offers a decentralized and secure platform for storing and sharing credit data, potentially empowering businesses with greater control over their own information.

Does Floor And Decor Report To Dun And Bradstreet

Conclusion

While the reporting practices of companies like Floor & Decor to D&B may remain shrouded in secrecy, the importance of strong business credit cannot be overstated. By understanding the significance of reporting to agencies like D&B, businesses of all sizes can take proactive steps to enhance their creditworthiness, improve their access to financing, and strengthen their position in the competitive business landscape.

Through building sound financial practices and engaging with the evolving landscape of business credit reporting, companies can unlock the full potential of their credit history and gain a significant advantage in today’s dynamic economy.