Imagine this: you’re relaxing at home, enjoying a quiet evening when a sudden gurgling sound from your kitchen draws your attention. You rush to investigate and find water cascading out from under your sink, quickly engulfing the floor and soaking your beautiful hardwood. Your heart sinks as you realize the extent of the damage, wondering if your homeowners insurance will cover the costly repairs. This real-life scenario highlights a question many homeowners grapple with: does homeowners insurance cover water damage to floors?

Image: thedamagechoices.blogspot.com

The answer, unfortunately, isn’t a simple yes or no. The coverage for water damage to floors depends on several factors, including the cause of the damage, the type of flooring, your policy specifics, and your insurance provider. Navigating the intricacies of homeowners insurance can feel like wading through a swamp of policies and clauses, so let’s break down the crucial details to help you understand what’s covered and what might leave you footing the bill.

Understanding the Basics of Homeowners Insurance

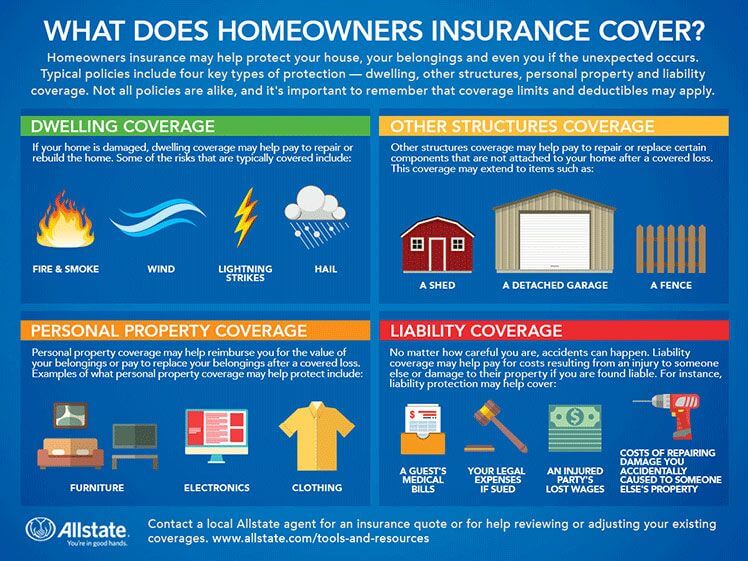

Homeowners insurance is a crucial safety net that protects your property and finances against unexpected events, from fire and theft to natural disasters. While every policy differs, most standard homeowners insurance policies include coverage for:

- Dwelling Coverage: This covers damage to your home’s structure, including the roof, walls, and foundation.

- Personal Property Coverage: This protects your belongings inside your home, like furniture, electronics, and clothing.

- Liability Coverage: This safeguards you against legal claims if someone is injured on your property.

- Additional Living Expenses: This covers your temporary lodging and other expenses if your home becomes uninhabitable due to a covered event.

However, it’s essential to remember that homeowners insurance policies typically have specific exclusions and limitations, such as pre-existing conditions or damage caused by negligence. Water damage is one area where coverage can be complex, as not all water-related events are considered equally.

When Does Homeowners Insurance Cover Water Damage to Floors?

Homeowners insurance policies generally cover water damage to floors resulting from specific events, such as:

- Burst Pipes: If a pipe in your home bursts, causing water to flood and damage your floors, most homeowners insurance policies will cover the repairs.

- Severe Storms and Floods: While most standard policies exclude flood damage, some policies offer optional flood coverage. If your home is damaged by a severe storm or flood that also impacts your floors, your coverage will depend on the specific terms of your policy.

- Appliance Malfunctions: If a washing machine, dishwasher, or refrigerator malfunctions and spills water, damaging your floors, this is typically covered under your homeowners insurance.

- Sudden and Accidental Water Damage: If a pipe leaks or breaks unexpectedly, leading to water damage, your insurance policy might cover the repairs.

What Water Damage to Floors Might NOT Be Covered

While most homeowners insurance policies cover water damage to floors caused by sudden and unexpected events, some instances are typically excluded, including:

- Gradual Water Damage: If water damage to your floors occurs gradually, such as due to a slow leak or ongoing moisture buildup, your insurance might not cover the repairs. Your policy may require evidence of a sudden and accidental event.

- Negligence: If you fail to maintain your home’s plumbing system and the damage occurs due to a preventable leak, your insurance may not cover the repairs.

- Flood Damage: Most standard homeowners insurance policies do not cover flood damage. To secure protection against floods, you need to purchase a separate flood insurance policy.

- Pre-existing Conditions: If water damage to your floors existed before you purchased your homeowners insurance, your policy likely won’t cover repairs.

Image: www.allstate.com

Factors Affecting Water Damage Coverage

Several factors can influence whether your homeowners insurance policy covers water damage to your floors. These include:

- The Type of Flooring: The type of flooring you have can affect coverage. Some policies might have different limits for different flooring types, or they may have higher deductibles for certain types of flooring.

- The Cause of the Damage: As mentioned earlier, the cause of the water damage is crucial. Unexpected events are usually covered, while gradual or preventable damage might not be.

- The Severity of the Damage: The extent of the water damage will affect the amount your insurance pays. If the damage is severe, you might have to cover more out-of-pocket expenses.

- Your Policy Deductible: Your deductible is the amount you’re responsible for paying before your insurance coverage kicks in. The higher your deductible, the lower your insurance premiums, but you’ll pay more out-of-pocket for covered repairs.

- Your Insurance Provider: Every insurance provider has its own policies and coverage limits. It’s crucial to carefully review the details of your policy and understand what your specific insurer covers.

What To Do After Water Damage

If you experience water damage to your floors, take these steps immediately:

- Stop the Source of the Water: The first priority is to stop the source of the water, whether it’s a leaking pipe or a malfunctioning appliance.

- Document the Damage: Take clear photos and videos of the damage to your floors and the surrounding area. These records will be essential for your insurance claim.

- Contact Your Insurance Company: Report the water damage to your insurance company as soon as possible. Provide them with detailed information about the incident and the extent of the damage.

- Get Expert Help: Contact a qualified water damage restoration professional to assess the damage and begin the repair process. They will provide estimates for repairs and can guide you through the process of filing an insurance claim.

Tips for Protecting Your Floors and Ensuring Coverage

Protecting your floors from water damage is essential for your home’s value and your financial well-being. Here are some tips to minimize the risk of water damage and ensure your insurance covers potential repairs:

- Regular Plumbing Inspections: Schedule regular inspections of your plumbing system to identify potential leaks or problems early. This proactive approach can prevent major damage.

- Maintain Your Appliances: Ensure your appliances, like washing machines, dishwashers, and refrigerators, are properly maintained and in good working order.

- Install Water Detectors: These devices can detect leaks and alert you immediately, allowing you to take action before the damage becomes extensive.

- Invest in Flood Insurance: If your home is in a flood zone, consider investing in a separate flood insurance policy to protect your investment.

- Review Your Homeowners Insurance Regularly: Regularly review the details of your homeowners insurance policy to ensure you have adequate coverage and understand the limitations of your policy.

Does Homeowners Insurance Cover Water Damage To Floors

Conclusion

Water damage to floors can be a significant expense, but understanding the nuances of homeowners insurance coverage can help you navigate this situation with confidence. By knowing what’s covered and what’s excluded, taking preventive steps, and understanding your responsibilities, you can protect your home and your finances from this potentially costly challenge. If you’re ever unsure about your homeowners insurance coverage, don’t hesitate to contact your insurance agent for clarification or advice. This proactive approach can safeguard your home and peace of mind.