Ever felt like accounting was a cryptic language, full of mysterious debits and credits? You’re not alone! But fear not, understanding the general journal is the key to unlocking a world of financial clarity. So, let’s dive into the fascinating world of Problem 6-5, and learn how to record general journal transactions like a pro.

Image: www.chegg.com

This article takes you on a journey through the intricacies of problem 6-5, a classic example in accounting textbooks. By dissecting the scenario and analyzing its transactions, we’ll demystify the process of recording journal entries for common business activities. Whether you’re an accounting student, a business owner, or just curious about the inner workings of finances, this comprehensive guide will equip you with the knowledge and tools to tackle any general journal problem head-on.

Unveiling the General Journal

The Heart of Accounting

Imagine the general journal as the accounting department’s diary, capturing every financial event in a chronological order. It reflects the lifeblood of a business, tracking the ebb and flow of money, assets, and liabilities. Each entry in the journal is a complete record of a transaction, detailing its date, accounts involved, and the amount.

The Essence of Double-Entry Bookkeeping

Accounting, at its core, operates on a simple yet powerful concept: the double-entry system. For every transaction, there are two sides to the story – a debit and a credit. These entries must always balance, reflecting the fundamental principle of accounting: assets must equal liabilities plus equity. This balance ensures that the financial picture remains consistent and reliable.

Consider a simple example: a company purchases office supplies for $100. This transaction affects two accounts:

- Office Supplies (an asset) – Increases by $100 (Debit)

- Cash (an asset) – Decreases by $100 (Credit)

The increase in office supplies is recorded as a debit, while the decrease in cash is recorded as a credit. The two entries balance each other, reflecting the fundamental accounting equation.

Image: www.chegg.com

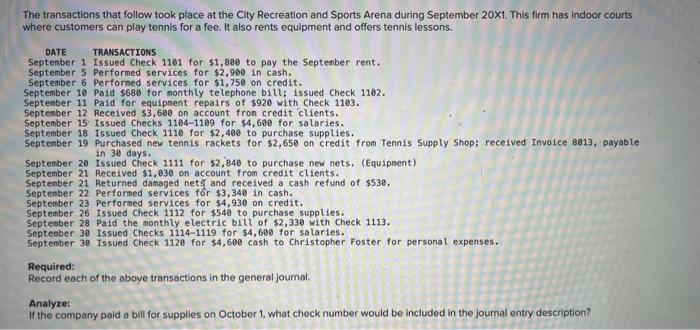

Deconstructing Problem 6-5

Now, let’s delve into Problem 6-5, our chosen example to illuminate the general journal in action. This problem typically presents a series of business transactions that require you to:

- Identify the accounts impacted by each transaction.

- Determine whether those accounts will be debited or credited.

- Record the transaction in a general journal entry.

Problem 6-5 might involve situations like:

- Sales on credit – This increases both accounts receivable (an asset) and sales revenue (an equity account).

- Purchases of inventory – This increases inventory (an asset) and decreases cash or increases accounts payable (a liability) depending on the payment method.

- Payment of salaries – This decreases cash (an asset) and increases salary expense (an equity account).

- Receipt of cash from customers – This increases cash (an asset) and decreases accounts receivable (an asset).

Each transaction presents a unique combination of accounts to be debited or credited, providing valuable practice in applying the double-entry system.

Mastering the Art of Journal Entries

Recording general journal entries might seem daunting at first, but it simplifies with practice and understanding. Here’s a step-by-step guide to tackle any transaction:

Step 1: Identify the Accounts

Carefully analyze the transaction and pinpoint the accounts involved. Consider what assets, liabilities, equity, revenues, and/or expenses are affected. For example, if a company sells goods for cash, the accounts involved are cash (an asset) and sales revenue (an equity account).

Step 2: Determine Debits and Credits

This is the heart of the double-entry system. Use the mnemonic “DEAD CLIC” to remember the rules:

- Debits Increase: Debits, Assets, Expenses, Dividends

- Credits Increase: Cash, Liabilities, Income, Capital (equity), Revenue

For instance, if the transaction involves the purchase of office supplies, office supplies (an asset) will increase, requiring a debit. Cash (an asset) will decrease, leading to a credit entry.

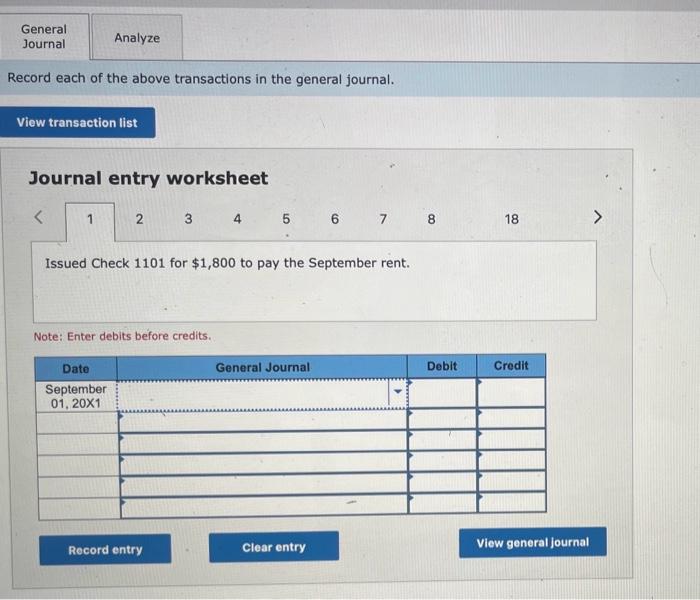

Step 3: Record the Entry

Now, organize the information into a formal general journal entry. Typically, these entries include:

- Date: The date the transaction occurred.

- Account Debited: The account that increases (or decreases if a liability or equity account).

- Account Credited: The account that decreases (or increases if a liability or equity account).

- Debit Amount: The amount of the debit entry.

- Credit Amount: The amount of the credit entry.

- Brief Description: A concise description of the transaction.

These entries should always balance, meaning the total debit amount must equal the total credit amount.

Beyond Problem 6-5

While Problem 6-5 is an excellent starting point, the world of general journal transactions extends far beyond these basic examples. Accounting is a dynamic field that evolves with business practices. From recording complex financial instruments to navigating international accounting standards, the general journal remains the fundamental tool for tracking financial activity.

Understanding the fundamentals of the general journal unlocks the ability to interpret financial statements, make informed business decisions, and ensure transparency and accountability within an organization. As you progress in your accounting journey, you’ll encounter a wide array of transactions, each presenting its unique story within the language of the general journal.

Problem 6-5 Recording General Journal Transactions

Conclusion

Mastering the general journal is not merely about memorizing debit and credit rules; it’s about understanding the narrative behind every financial transaction. Problem 6-5 serves as a foundation, a stepping stone to unlocking the power of accounting. Armed with the knowledge gained from this guide, you can confidently navigate the intricacies of financial recording and gain a deeper understanding of the story behind the numbers.

Continue exploring, seeking out more challenging scenarios, and practicing your skills. The journey of mastering the general journal is a rewarding one, ultimately leading to a greater command of financial literacy and the ability to decipher the language of business.