Have you ever stared at a jumbled mess of receipts, invoices, and bank statements, wondering how on earth to turn that chaos into a coherent financial picture? You’re not alone. Many aspiring business owners and budding accountants grapple with the art of efficiently recording and organizing business transactions. This is where the magic of journalizing and posting comes into play – a crucial foundation for sound financial management.

Image: www.chegg.com

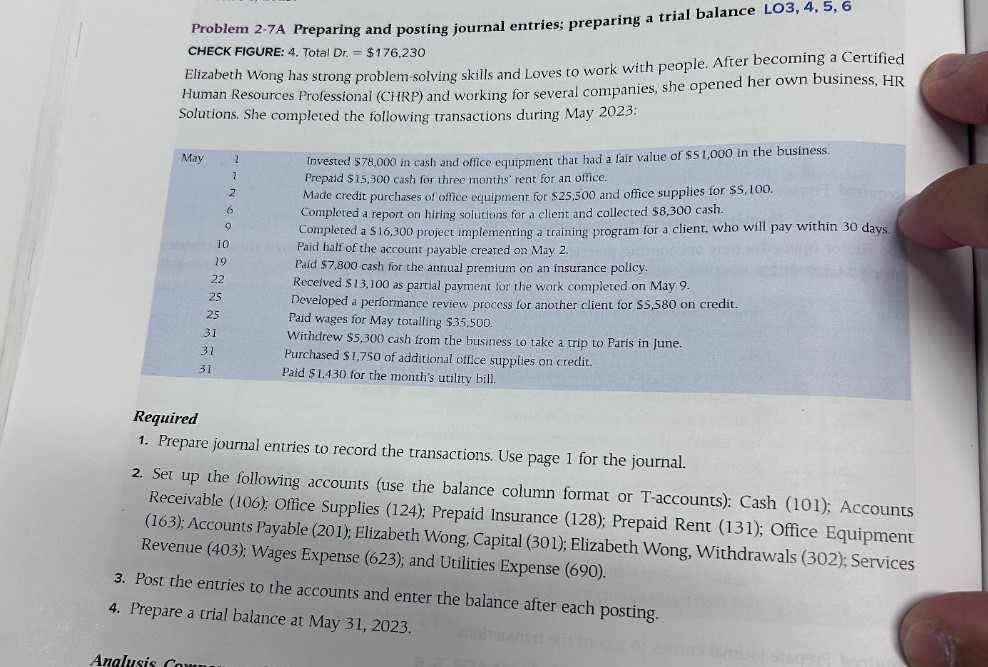

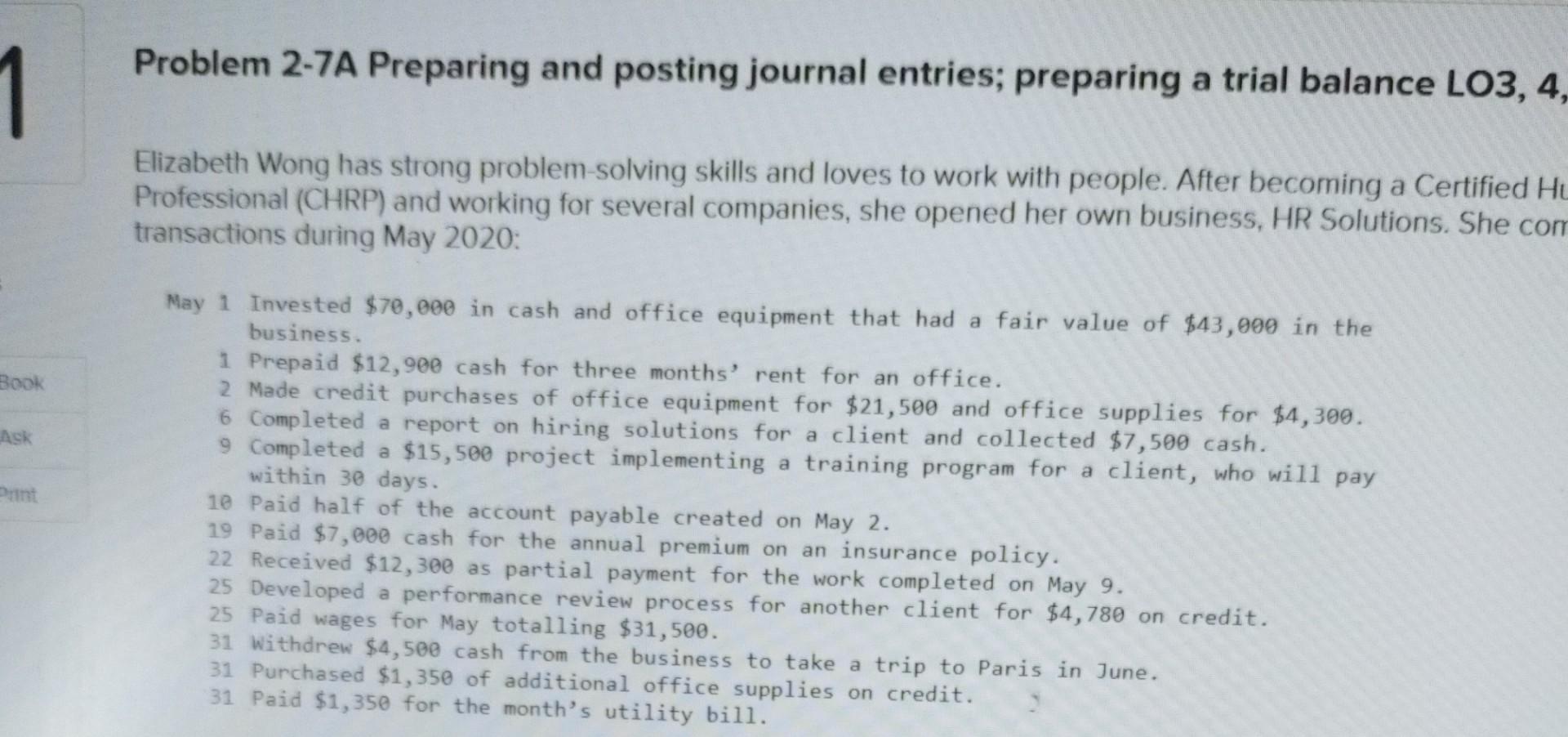

This article delves into Problem 7-8 – a common exercise that often appears in accounting textbooks and assignments. We’ll break down the steps, demystify the concepts, and guide you through the process of journalizing and posting business transactions with confidence. Whether you’re a student tackling your coursework or a business owner seeking to strengthen your financial literacy, this guide will empower you with the knowledge and tools needed to navigate the often-intimidating world of accounting.

Understanding the Fundamentals

What is Journalizing?

Journalizing is like keeping a detailed diary for your business’s financial life. It involves recording each transaction in a chronological order in a journal. This journal serves as the first step in the accounting cycle, capturing the essence of every business event.

The Journal Entry

Each transaction is recorded as a journal entry, which typically includes the following elements:

- **Date:** When the transaction occurred.

- **Account Titles:** Identifies the specific accounts affected by the transaction (e.g., Cash, Accounts Receivable, Inventory, Sales).

- **Debit Amount:** Represents the increase in an asset account or the decrease in a liability or equity account.

- **Credit Amount:** Represents the decrease in an asset account or the increase in a liability or equity account.

- **Description:** Provides a brief explanation of the transaction.

Image: www.chegg.com

The Golden Rule of Accounting

The foundation of journalizing lies in the “Golden Rule” of accounting: “Debit the receiver, credit the giver.” This rule helps you determine which accounts to debit and which to credit for each transaction.

Example: Purchasing Inventory on Credit

Imagine your company buys $1,000 worth of inventory on credit from a supplier. Here’s how to journalize this transaction:

- Debit: Inventory (Asset increase) – $1,000

- Credit: Accounts Payable (Liability increase) – $1,000

What is Posting?

Posting is the process of transferring information from the journal to the ledger. The ledger is a collection of accounts that provides a summarized view of each account’s activity.

General Ledger

The General Ledger is the heart of the accounting system. It organizes all the business’s accounts, such as:

- Assets (e.g., Cash, Accounts Receivable, Inventory)

- Liabilities (e.g., Accounts Payable, Notes Payable)

- Equity (e.g., Owner’s Equity, Retained Earnings)

- Revenue (e.g., Sales, Service Revenue)

- Expenses (e.g., Rent Expense, Salaries Expense)

Trial Balance

After posting, a Trial Balance is prepared to ensure the accounting equation (Assets = Liabilities + Equity) remains balanced. This step helps detect any errors in journalizing and posting.

Problem 7-8: A Deep Dive

Scenario Breakdown

Problem 7-8 typically provides a series of transactions for a specific business. This problem often involves various types of business activities, such as sales, purchases, cash receipts, cash disbursements, and other events that affect the company’s financial position.

Analyzing the Transactions

The key to success in Problem 7-8 lies in carefully analyzing each transaction. Determine the accounts affected, whether the accounts are increasing or decreasing, and whether to debit or credit the accounts using the “Golden Rule.” Be sure to clearly understand the impact of each transaction on the business’s financial statements.

Preparing the Journal Entries

Once you thoroughly understand the nature of each transaction, you can prepare the journal entries. Remember to follow the proper format and include all necessary information, such as the date, account names, debit and credit amounts, and a brief description.

Posting to the Ledger

After journalizing all transactions, the next step is to post the information to the general ledger. This process involves summarizing the journal entry information in each respective account. For example, if a transaction involved increasing the Inventory account, you would post the debit amount to the Inventory ledger account.

Preparing the Trial Balance

Finally, prepare a trial balance to ensure that the debits and credits in the ledger are equal. This is crucial to maintaining the accounting equation. If the trial balance is unbalanced, it indicates there may be an error in the journal entries or posting process.

Tips for Success

Here are some essential tips to help you master the art of journalizing and posting business transactions:

- Read Carefully: Pay close attention to the details provided in the problem. Some transactions might require additional calculations or involve specific accounting principles.

- Use a Systematic Approach: Follow a structured process, such as the steps outlined above, to ensure you don’t miss any important steps. This also helps prevent errors.

- Practice Regularly: Journalizing and posting can be challenging, but with consistent practice, you’ll become more comfortable and familiar with the process.

- Seek Help When Needed: If you’re struggling with a particular concept, don’t hesitate to ask your instructor, tutor, or classmates for clarification.

Problem 7-8 Journalizing And Posting Business Transactions Answers

Conclusion

Mastering journalizing and posting is an essential skill for anyone involved in accounting or business management. By understanding the key concepts, following the steps outlined in this article, and practicing regularly, you’ll gain the confidence needed to accurately reflect your business’s financial activity. Problem 7-8 and similar exercises provide valuable learning opportunities that equip you with the foundational knowledge to navigate the complex world of accounting. Remember, practice makes perfect, and with dedication, you can become a financial accounting pro!