Have you ever stared at your JetPay employee pay stub, feeling a mix of confusion and curiosity? You’re not alone. The seemingly cryptic information on this document can leave even the most financially savvy individuals scratching their heads. But worry not, this comprehensive guide will break down the intricacies of your JetPay pay stub, making it a clear and understandable reflection of your hard-earned income.

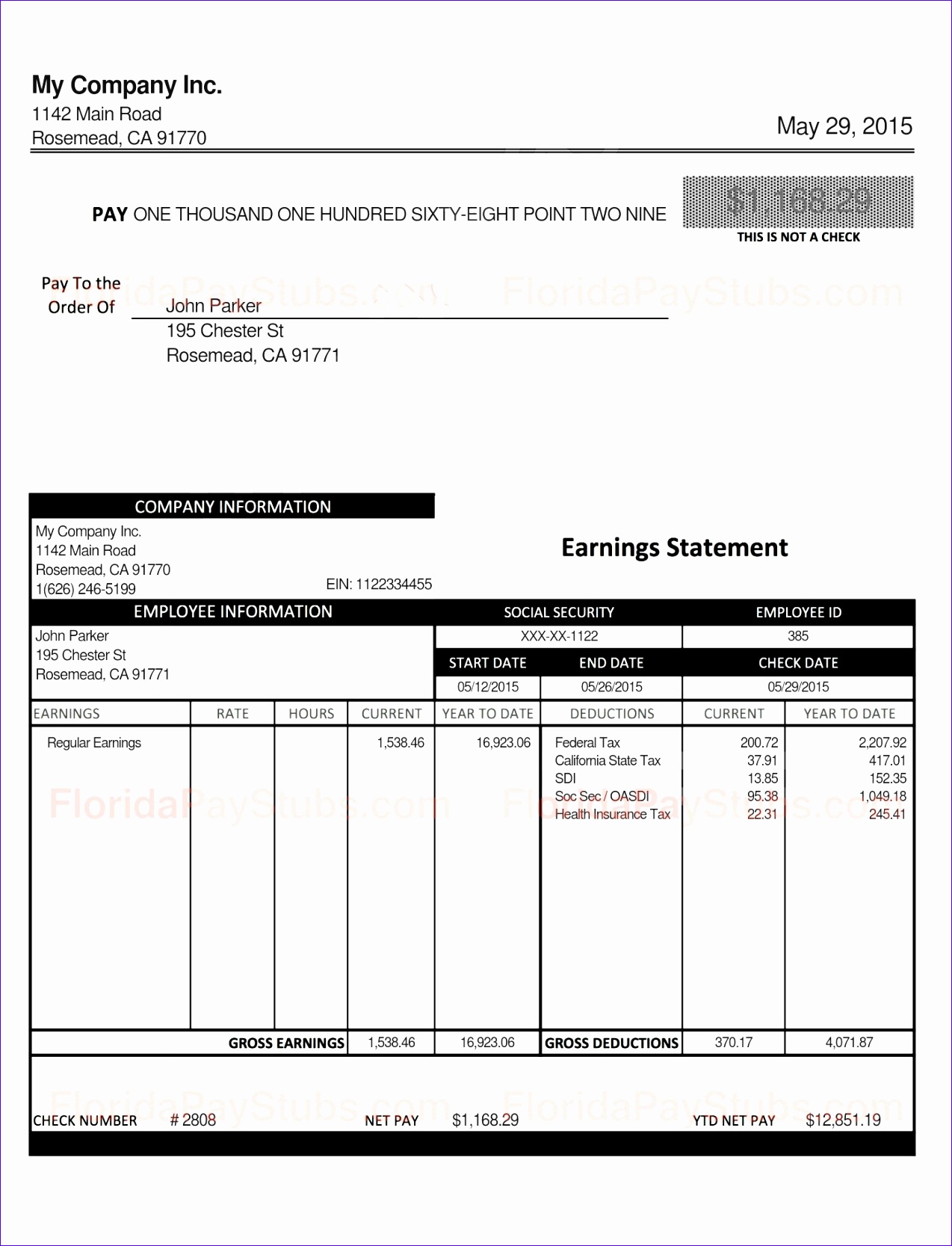

Image: www.hotzxgirl.com

Understanding your pay stub is vital. It’s not just a piece of paper detailing your earnings, but a window into your financial well-being. It reveals essential details like your gross pay, deductions, and net pay, allowing you to monitor your finances, make informed decisions about your spending, and even plan for the future.

Dissecting the Structure: Unveiling the Components of Your Pay Stub

Your JetPay pay stub is structured in a straightforward manner, with each section providing specific information about your compensation and deductions. Let’s dive into each section:

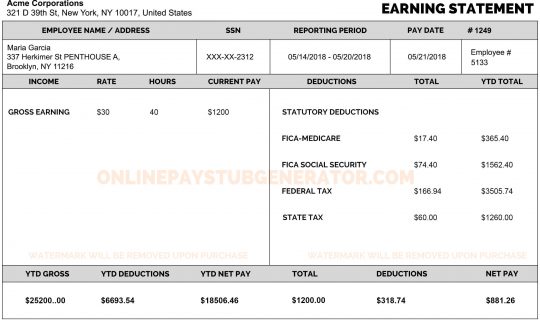

Employee Information: The Basics

This section provides essential information about you, the employee, including your name, employee ID number, pay period, and pay date. It’s the foundation of your pay stub, ensuring the correct person receives their compensation.

Earnings: The Heart of Your Compensation

This section lists all the income you’ve earned during the pay period. You might find multiple entries here, representing different types of earnings, such as:

- Regular Pay: Your base salary or hourly rate, representing the standard income earned for your work.

- Overtime Pay: Compensation for working beyond your regular hours, typically at a higher rate than your regular pay.

- Bonus or Commission: Additional payments earned based on specific performance goals or sales achieved.

- Vacation Pay: Payment for unused vacation time, which may be accrued over time.

- Sick Leave Pay: Compensation for time taken off due to illness, which can be accrued similarly to vacation pay.

Image: www.onlinepaystubgenerator.com

Deductions: Allocating Your Earnings

This section highlights the deductions taken from your gross earnings. Deductions can be divided into two main categories:

Mandatory Deductions: Not Negotiable

- Federal Income Tax: A percentage of your income contributed to the federal government to fund various public services and programs.

- State Income Tax: Depending on your state of residence, a percentage of your income may be deducted for state-specific services and programs.

- Social Security Tax: A portion of your earnings contributed to the Social Security system, providing retirement benefits, disability insurance, and survivor benefits.

- Medicare Tax: A percentage of your earnings contributed to Medicare, offering health insurance for individuals over 65 and those with disabilities.

Optional Deductions: Tailoring Your Paycheck

Beyond the mandatory deductions, your pay stub might include optional deductions based on your individual preferences and needs:

- Health Insurance Premiums: Payments for medical insurance coverage, often chosen through your employer’s plan.

- Dental and Vision Insurance Premiums: Deductions for coverage related to dental and vision care, often part of a comprehensive benefits package.

- Life Insurance Premiums: Payments for life insurance, offering financial protection to your beneficiaries in case of your passing.

- 401(k) Contributions: Pre-tax deductions that directly contribute to your retirement savings plan, offered through your employer.

- Flexible Spending Accounts (FSAs): Contributions to accounts for pre-tax spending on eligible healthcare expenses or childcare costs.

- Union Dues: Payments to a union if you are a member, representing worker interests and negotiating benefits.

- Other Deductions: This might include any additional deductions specific to your employer or benefits package, like student loan payments, charitable contributions, or garnishments.

Understanding Your Paycheck: The Net Pay Breakdown

After factoring in your earnings and deductions, your pay stub reveals your net pay, which is the amount you actually receive after all withholdings. This is your take-home pay, the money that arrives in your bank account or is used for direct deposit.

Your net pay, while seemingly simple, is the culmination of all the elements on your pay stub. Knowing where your money goes and what factors contribute to your final take-home pay is essential for financial planning, budgeting, and making informed decisions about your earnings.

Key Takeaways for Maximizing Your Financial Picture

Your JetPay pay stub is a valuable tool, providing insights into your earnings and financial well-being. It’s not just a document to file away; it’s a powerful resource for:

- Tracking Your Earnings: Monitor your income, ensuring accuracy and identifying any discrepancies.

- Creating a Budget: Use your net pay as the foundation for creating a realistic budget that aligns with your financial goals.

- Making Informed Tax Decisions: Understand the impact of deductions on your overall tax liability.

- Reviewing and Adjusting Benefits: Evaluate your insurance and retirement contributions to optimize your benefits package.

- Identifying Potential Errors: Be vigilant in reviewing your pay stub for any mistakes or discrepancies, ensuring timely correction.

Taking Control of Your Finances: Beyond the Pay Stub

While your pay stub provides valuable information, it’s only one piece of the financial puzzle. Taking proactive steps to manage your money effectively is key to achieving your financial goals. Here are some actionable steps:

- Budgeting and Saving: Establish a clear budget that aligns with your spending habits and financial aspirations. Prioritize saving a certain percentage of your income for emergencies, retirement, and other goals.

- Investing for the Future: Explore different investment options, including stocks, bonds, and mutual funds, to maximize your long-term financial growth.

- Managing Debt Wisely: Develop a debt management plan to reduce high-interest debt, like credit card balances, and avoid accumulating excessive debt.

- Seeking Professional Guidance: Consider consulting a financial advisor or planner to get personalized advice and explore strategies for reaching your financial goals.

Jetpay Employee Pay Stub

Conclusion: Empowering You to Decode Your Financial Future

Understanding your JetPay employee pay stub is a pivotal step towards taking control of your finances. It’s a document that offers valuable insights into your earnings, deductions, and net pay, empowering you to make informed decisions about your money. By demystifying the information on your pay stub and proactively managing your finances, you lay the foundation for achieving your financial goals and building a brighter future.