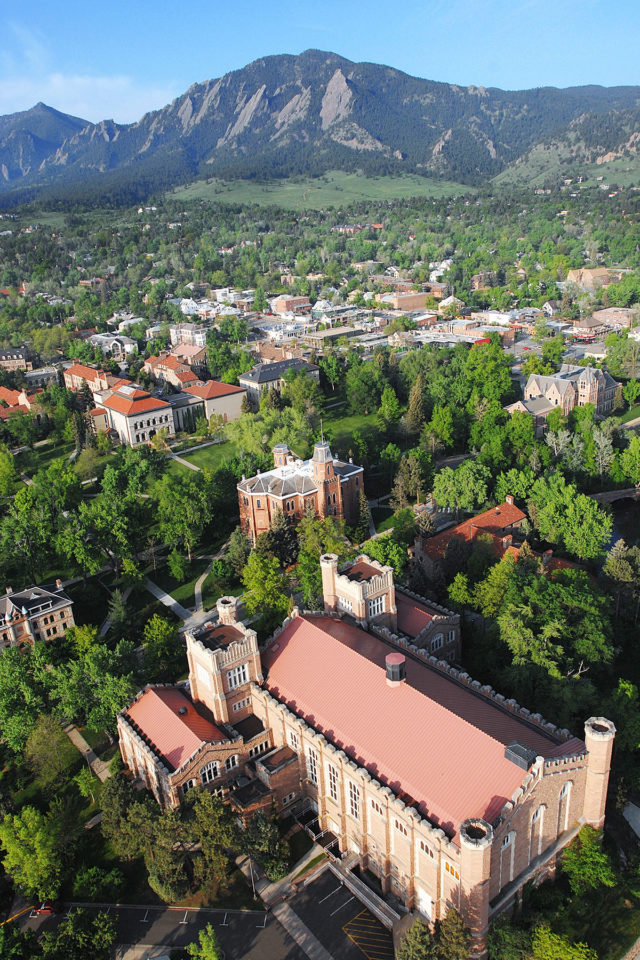

Picture this: the crisp mountain air, the vibrant energy of a bustling college campus, and the promise of an unforgettable college experience at the University of Colorado Boulder. It’s a dream for many, but the reality of out-of-state tuition costs can be a daunting hurdle. This guide will equip you with the knowledge and tools to understand the financial landscape and explore the various options available to navigate this challenge.

Image: www.sudrum.com

The University of Colorado Boulder, nestled in the foothills of the Rocky Mountains, is a renowned institution known for its academic excellence, vibrant campus life, and incredible outdoor adventure opportunities. However, for students residing beyond Colorado’s borders, the prospect of attending CU Boulder can seem financially daunting due to the significantly higher tuition rates imposed on out-of-state students.

Decoding the Out-of-State Tuition Landscape

Understanding the financial implications is crucial for making informed decisions. At CU Boulder, the cost of tuition for out-of-state students is dramatically higher than for in-state residents. As of the 2023-2024 academic year, out-of-state students are facing an annual tuition bill of $42,000 compared to $11,922 for in-state students. This substantial difference highlights the financial burden associated with pursuing a CU Boulder education as an out-of-state student.

The reasons behind this discrepancy are multifaceted. State universities, like CU Boulder, are primarily funded by state taxes. Colorado residents are contributing to the university through their taxes, hence the lower tuition rates they enjoy. Out-of-state students, however, do not contribute to the state’s tax base and therefore are not eligible for the same tuition subsidies.

Strategies to Mitigate Out-of-State Tuition Costs

While the financial reality can seem intimidating, there are several avenues you can explore to lessen the impact of out-of-state tuition. Here’s a breakdown of potential strategies:

1. Scholarships and Financial Aid

Financial aid and scholarships are invaluable resources for out-of-state students seeking to ease the burden of tuition costs. CU Boulder offers a plethora of scholarships based on various criteria, including academic merit, community involvement, and financial need.

The CU Boulder Scholarship Office is an excellent starting point for exploring scholarship opportunities. Begin your search by creating a profile on the CU Boulder Scholarship Portal, which allows you to match your background and interests with available scholarships. The portal also provides valuable tips on crafting compelling scholarship applications.

Image: univchoices.blogspot.com

2. Residency Requirements

While obtaining in-state residency status is not a quick fix, it can offer a long-term solution to out-of-state tuition. CU Boulder’s residency requirements are relatively stringent. The university requires students to establish bona fide (meaningful and genuine) residency in Colorado for at least one year prior to the start of classes. This means that simply moving to Colorado just before starting school is not sufficient. You’ll need to demonstrate that you’ve made Colorado your permanent home by proving factors like:

- Employment: Having a full-time job in Colorado with a designated Colorado address.

- Taxes: Filing Colorado state income taxes as a resident.

- Voter Registration: Registering to vote in Colorado.

- Driver’s License: Obtaining a Colorado driver’s license.

- Housing: Renting or owning a property in Colorado with a permanent address.

It’s important to note that residency status can be a complex issue, involving intricate legal interpretations and requirements. It’s advisable to consult with the CU Boulder Office of Admissions or a legal professional to assess your individual eligibility for in-state tuition status.

3. Explore Reciprocity Agreements

Some states have reciprocal agreements with Colorado regarding tuition rates. If your state of origin has a tuition reciprocity agreement with Colorado, you might be eligible for a reduced tuition rate. The agreements often require you to be a resident of your state for a specified period and meet other specific requirements.

To find out if your state has a reciprocity agreement, visit the CU Boulder Office of Admissions website or contact them directly for personalized guidance. Understanding these agreements can significantly impact your overall tuition costs.

4. Military Benefits

For students with military backgrounds, CU Boulder offers a range of benefits and programs, potentially including reduced tuition rates. The Military and Veteran Services Office provides comprehensive resources and support for veteran and military-affiliated students. If you are eligible, these benefits can significantly lessen the financial burden of out-of-state tuition.

Expert Insights and Actionable Tips

Navigating the complexities of out-of-state tuition requires a strategic and proactive approach. Here are some key recommendations from experts in the field of financial aid and college admissions:

- Start early: The earlier you begin your research on scholarships, financial aid options, and residency requirements, the more time you have to explore and prepare.

- Don’t be afraid to ask for help: The CU Boulder Office of Admissions, Financial Aid Office, and Scholarship Office are invaluable resources. Their staff is dedicated to supporting students and answering questions.

- Seek external support: Explore potential scholarships offered by private organizations, foundations, or community groups.

- Develop a budget: Create a comprehensive budget that outlines your expected costs, including tuition, housing, food, and other expenses.

- Explore alternative financing options: If scholarships and financial aid fail to cover your tuition needs, consider student loans or other financing options.

Out Of State Tuition University Of Colorado Boulder

Conclusion

Embarking on a CU Boulder adventure as an out-of-state student may seem like a daunting financial challenge, but with the right information, strategy, and support, you can turn your dreams into reality. Stay informed, be proactive, and leverage the various resources available to you. At CU Boulder, a world of possibilities awaits, and the journey may start with navigating tuition costs, but the rewards of a CU Boulder experience are truly worth the effort.